Do you think that every country is as financially stable and safe as they appear? Time moves fast, and the interest on loans increases even faster. Governments that fail to adapt will struggle to continue their role, let alone strive. This explains why there are 54 low-income countries that are facing unsustainable debt levels.

As we move further into 2025, more solutions are required to combat governments piling up debts and resulting in a default of the loan accrued. In order for governments to break this loop of borrowing money and to shape the next era of budgeting finances, governments need to be more dependent and not be fooled by the trap of accumulating arrears.

In this blog, I will be addressing how the idea of Governments borrowing money can spiral into the downfall of the country’s financial situation and how Governments should stray away from the idea of borrowing money in the first place.

- Global debt is at record highs due to pandemic recovery, social programs, and infrastructure spending.

- High debt carries risks like rising interest payments, inflation, and potential defaults if borrowing becomes unsustainable.

- Sustainability depends on growth—if economies expand faster than debt, it remains manageable; otherwise, crises may arise.

- Solutions exist but are challenging, including cutting deficits, restructuring debt, and fostering economic growth.

The consequences of the Covid-19 pandemic are not just short term but extend to the long-term as well. The pandemic aftermath caused massive spending on relief programs, healthcare and economic recovery to return to a similar financial situation to that prior the pandemic. Governing bodies only have a limited time to act on an issue before the only option left is to take a loan out which will most likely solve the issue in the short run.

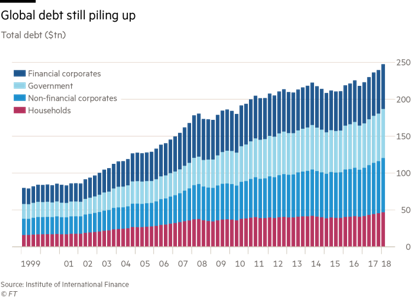

This leads me on to my next point, of numbers proving it.

Case study: Ghana

In total, between 2007 and 2015, Ghana borrowed $18.2 billion of external loans and paid back $9 billion leaving around $9.2 billion to be spent in the Ghanaian economy. During the years of 2013 and 2014, the price of oil and gold fell significantly, this caused size of Ghana’s economy to fall from $47.8 billion in 2013 to $36 billion in 2015. As external debts are owed in foreign currencies, the size of the debt increases, in this situation the debt increased by 44%. In order to be able to repay the loan, the Ghanaian Government took another loan from the International Monetary Fund to bail out previous lenders. And to return the loans of the IMF, the Government would increase taxes and cut government spending.

On the right, is a diagram displaying how the debts of the whole world are distributed between each country and it comes with no big surprise that the countries with the highest share of global debt are the international powerhouses: USA and China. A reason these countries are at the top of the charts might be because of their perpetual military and defence spending due to increased global tensions leading to higher defence budgets.

Other reasons for such high Government debt could follow along the lines of:

a) Increasing rates of inflation and interest rates – as the bank rate increases the higher the borrowing cost becomes

b) Aging population and social programs – as the population of countries get older and older, more spending on pensions, healthcare, and welfare can be done to assist this aging population

c) Infrastructure and climate investments - green energy projects and rebuilding aging infrastructure works towards the issue of the deterioration of the world we live in and can massively contribute to the prevention of destruction

Case study: Pakistan

Similarly to Ghana, Pakistan has a very high value of external debts which reached $59 billion by 2016. A big factor of this loan was due to the National Drainage Program which Pakistan loaned out $500 million to improve the irrigation system. However this program was prevented as it violated six of the World Bank’s safeguarding policies. These loans have other disadvantageous impacts which halt the development of the country causing instability. Since 2010, the country has been named ‘middle income’, however the national income per person is only £1,100.

- Issuing Government Bonds – Governments raise funds by selling bonds to domestic and foreign investors, promising repayment with interest. These bonds are considered relatively safe investments, attracting pension funds, banks, and foreign central banks.

Case study: USA

The U.S. finances much of its debt through Treasury bonds, which are considered among the safest assets worldwide. Investors, including foreign governments like China and Japan, hold large portions of U.S. debt. While this method allows the U.S. to borrow at low interest rates, concerns arise over long-term debt sustainability, especially during periods of high government spending.

- Borrowing from International Institutions – Countries facing financial crises or development challenges may seek loans from institutions like the International Monetary Fund (IMF) or the World Bank, often under strict economic reform conditions.

- Printing More Money – In some cases, governments finance debt by increasing the money supply, which can lead to inflation or even hyperinflation if not managed properly.

- Taxation and Austerity Measures – To service debt, governments may raise taxes or cut public spending. This approach can slow economic growth but helps maintain fiscal discipline.

- Sovereign Wealth Funds (SWFs) & Reserves – Some nations use accumulated reserves or wealth funds, often from natural resource revenues, to manage debt without excessive borrowing.

- Selling State-Owned Assets – Governments may privatise public enterprises or sell valuable assets to generate funds, reducing the need the borrowing.

Case study: Japan

Japan has one of the highest debt-to-GDP ratios globally but avoids a debt crisis by borrowing primarily from domestic investors, such as pension funds and insurance companies. With ultra-low interest rates, Japan has been able to sustain its high debt levels without facing severe economic instability. However, long-term risks include a shrinking population and slower economic growth, which may challenge debt repayment in the future.

What are the risks of rising debt?

- Higher Interest Payments – As government debt rises, a larger portion of the national budget must be allocated to interest payments, reducing available funds for essential public services such as healthcare, education, and infrastructure.

- Crowding Out Private Investment – When governments borrow heavily, they compete with the private sector for available credit, potentially driving up interest rates and making it more expensive for businesses and consumers to borrow.

- Inflationary Pressure – If a government resorts to printing money to cover debt, it can lead to inflation or, in extreme cases, hyperinflation, eroding the purchasing power of citizens.

Case study: Zimbabwe

In the 2000s, Zimbabwe’s government, under President Robert Mugabe, financed rising debt by excessively printing money. This approach led to one of the worst cases of hyperinflation in history, with annual inflation reaching an estimated 89.7 sextillion percent in 2008. Prices doubled every few hours, rendering the national currency worthless. The economic crisis resulted in severe food shortages, mass unemployment, and the eventual abandonment of the Zimbabwean dollar in favour of foreign currencies. The case highlights the dangers of using monetary expansion as a solution to rising debt.

- Currency Depreciation – High debt levels can weaken investor confidence, leading to capital flight and depreciation of the national currency, making imports more expensive and increasing inflation.

- Risk of Sovereign Default – If a country accumulates unsustainable debt, it may struggle to meet its repayment obligations, leading to default and financial instability.

- Reduced Fiscal Flexibility – High debt limits a government’s ability to respond effectively to economic crises, as borrowing more may worsen the situation or become too costly.

- Loss of Investor Confidence – If markets perceive a country’s debt as unsustainable, borrowing costs can increase sharply, making it harder for the government to finance itself.

Can Governments keep borrowing forever?

Factors That Allow Continuous Borrowing

- Strong Economic Growth – If a country’s economy grows faster than its debt, it can sustain borrowing indefinitely.

- Low Interest Rates – When borrowing costs are low, governments can roll over existing debt without significant financial strain.

- High Investor Confidence – Countries with stable economies and strong institutions attract investors who continue lending.

- Domestic Debt Ownership – Nations that borrow primarily from domestic sources (e.g., Japan) are less vulnerable to foreign investor sentiment.

- Control Over Monetary Policy – Countries with their own currency can print money to repay debt (though this risks inflation).

Risks and Limits to Borrowing

- Debt Crises & Default Risks – Excessive borrowing can lead to defaults if a country cannot meet its obligations.

- Rising Interest Rates – If borrowing costs increase, debt repayment becomes more expensive, potentially leading to economic downturns

- Inflation & Currency Devaluation – Printing money or excessive borrowing can weaken the national currency and lead to inflation.

- Crowding Out Effect – Too much government borrowing can limit credit availability for private businesses, slowing economic growth.

- Loss of Investor Confidence – If investors doubt a government’s ability to repay debt, borrowing costs rise, and capital may flee the country.

Case study: Argentina

Argentina has a history of excessive borrowing followed by defaults, including major debt crises in 2001 and 2020. Its reliance on foreign loans and lack of investor confidence have led to high interest rates, currency devaluation, and economic instability, forcing repeated IMF bailouts and austerity measures.

Are there any solutions to the debt crisis?

There are a few ways of reducing the national debt, some more successful than others:

- Buying Back Bonds – When the economy is struggling, these bonds and other financial securities can spur economic growth and aid recovery. This method is recognised as quantitative easing in the study of economics, this way the liquidity of money will increase allowing banks to be more willing to lend or invest.

- Interest Rates - Maintaining interest rates at low levels can help stimulate the economy, generate tax revenue, and ultimately reduce the national debt. Lower interest rates make it easier for individuals and businesses to borrow money for goods and services and this creates jobs and increases tax revenues.

- Raising Taxes - Tax hikes are a common practice but most nations face sizeable and growing debts. Increased revenues have little impact on a nation's overall debt level when cash flows increase but spending continues to rise.

- Bailout or Default – Many nations have been the beneficiaries of debt forgiveness. A default can include bankruptcy and/or restructuring payments to creditors which is a common and often successful strategy for debt reduction. This tends to spoil trade relationships for the future as countries that want to lend money will not be able to ensure a full recoup of the loan.

Case study: UK

On the back of the 2008 financial crisis, the UK was left in a disastrous and infamous recession. This problem was aggravated by the fact that prior to the crisis, banks were lending out mortgages to subprime borrowers (borrowers with a poor credit history). As fears of these risky loans spread, credit markets froze and several banks failed, requiring government bailouts.

Government bonds are seen as a ‘safe investment’, therefore, at the height of the credit crunch, there was strong demand for government bonds as people looked for security.

Case study: Sri Lanka

In 2022, Sri Lanka faced a devastating economic crisis, the loans they had taken out peaked at $83.6 billion including arrears. The Sri Lankan Government was forced to default their loans after blemishing a clean previous record. The IMF believed that the financial situation was too unstable and unsustainable in Sri Lanka, this meant that the Treasure Secretary had to state that they would suspend debt payments.

FAQs

What is the future of Government borrowing?

Global public debt is very high. It is expected to exceed $100 trillion, or about 93 percent of global gross domestic product by the end of this year and will approach 100 percent of GDP by 2030. There is a stark contrast between developed countries and developing countries, with the burden of this debt varying significantly, with countries' ability to repay it, exacerbated by inequality embedded in the international financial architecture.

What are the effects of increased Government borrowing?

Short term: increased government borrowing can boost economic activity by funding public spending on infrastructure, social programs, or stimulus measures. It may lead to lower interest rates if central banks intervene, but it can also crowd out private investment if borrowing drives rates higher. Additionally, it can create inflationary pressures, weaken the currency, and stimulate short-term economic growth.

Long term: increased government borrowing can lead to higher debt levels, requiring greater interest payments that may strain public finances and limit future spending. Persistent borrowing can crowd out private investment by keeping interest rates high, slowing economic growth. If debt grows unsustainably, it may reduce investor confidence, leading to higher borrowing costs and potential fiscal crises. Additionally, excessive debt can contribute to inflation and currency depreciation, while reliance on borrowing may reduce incentives for structural economic reforms. The long-term impact depends on how the debt is managed and whether it funds productive investments.

Can the value of the loans be kept secret or partially undisclosed?

Transparency of the loan value is beneficial for all parties involved in the transaction. This also gives lenders more certainty regarding the basis they are lending upon. However, below are a couple of infamous scandals which have been uncovered from situations where the value of the loans has been undisclosed.

Case study: Greece

In 2002, the US company Goldman Sachs created specific imitations of the loans to keep the debts of the books and hidden from the Greek people and EU rules. Against the regulations, Goldman Sachs were able to create additional credit up to $1 billion for the Greeks by making use of fictional exchange rates. To combat this, the Government had to incorporate strict austerity measures including

Case study: Malaysia

Originally, set up in 2009, 1MDB (1Malaysia Development Berhad) was a Malaysian state fund, however it has been the heart of one of the biggest corruption scandals. Some of the government guarantees given to loans were kept secret. Vast sums of money were borrowed by Government bonds and siphoned into Swiss, Singaporean and American accounts. This money was used to spend on luxurious goods under the pretence of money donated by a Saudi prince.

What are Fitch Ratings?

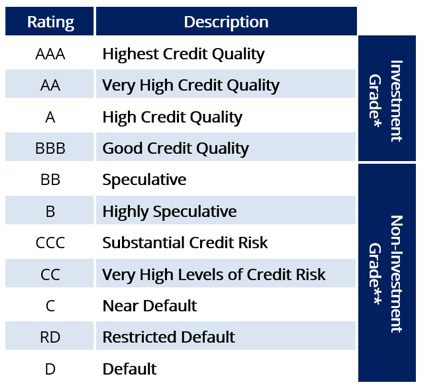

The different grades that could be possibly assigned to a Government depending on their track record with debtsFitch Ratings is a company that determines the financial stability of a government body by assigning a grade to describe the economic situation of the country. The company also evaluates the integrity of debt instruments such as Government bonds providing the lender to gain insights on how likely it is that they recoup their money. In other words, the company can predict approximately how likely the government body is going to default and fail repaying their loans.

Conclusion

Time moves fast, and the interest on loans increases even faster. Governing bodies that can adapt, innovate and stay on top of the loans accrued will benefit from the strongest financial situation in the near future.

No comments:

Post a Comment