With the drastic advancements of Artificial Intelligence, there is an adverse impact on stocks, cryptocurrency and blockchain and the role they will play in the future. We have already seen the wide acceptance of cryptocurrency for many years, however blockchain and cryptocurrency have massive potential to grow as emerging technologies.

What are blockchain and cryptocurrency? Blockchain is a database recording transactions and assets within a business or professional network. A ledger is usually used to record this shared between different individuals in the organisation and is immutable (not able to be changed). Cryptocurrency is a way of storing or transferring currency virtually.

Key Takeaways:

- Crypto and Blockchain Are Growing Beyond Money - Used in healthcare, banking, supply chains, and more—not just for digital coins.

- Big Companies and Governments Are Getting Involved - Banks, investors, and even governments are adopting crypto and digital currencies.

- Rules and Regulations Are Increasing - More laws are coming to protect users and stop scams, helping crypto become safer and more trusted.

- Technology Is Improving Fast - Blockchains are becoming faster, cheaper, and greener with new upgrades.

- The Internet Is Becoming More Decentralized (Web3) - Users are gaining more control through tools like dApps and DAOs, shifting power away from big tech and changing how the internet is managed and used.

Many people still think crypto is just about investing in Bitcoin or making quick money. But in reality, the technology behind crypto—blockchain—is being used for much more.

A blockchain is like a digital ledger (record book) that’s shared across many computers. Once information is added, it can’t easily be changed. That makes it great for:

-

Healthcare: Medical records can be securely stored and shared between hospitals without risking privacy.

-

Food supply chains: Supermarkets like Walmart use blockchain to trace where food came from, which helps prevent food safety issues.

-

Real estate and law: Property ownership can be stored on a blockchain, cutting down on paperwork and fraud.

We’re also seeing governments create Central Bank Digital Currencies (CBDCs)—digital forms of cash controlled by national banks. China already has a digital yuan, and countries like the UK and EU are working on their own.

This shift means blockchain and DLT are becoming real-world tools, not just part of the crypto hype.

In the early days of crypto, there were barely any rules. This made it feel exciting and “free,” but also risky and open to scams. Now, things are changing. Governments across the world are creating clearer regulations to protect investors and encourage safe innovation.

For example:

The EU’s MiCA law (Markets in Crypto-Assets) gives rules on how crypto assets should be handled and reported.

The UK is planning to regulate stablecoins (cryptos tied to the value of real money) and exchanges.

At the same time, large financial institutions are entering the space. BlackRock, one of the biggest asset managers in the world, launched a Bitcoin ETF (a way to invest in crypto like a stock). Visa and PayPal now offer crypto payment options. This shows that crypto is no longer just for tech geeks or early adopters—it’s being taken seriously by the mainstream financial world.

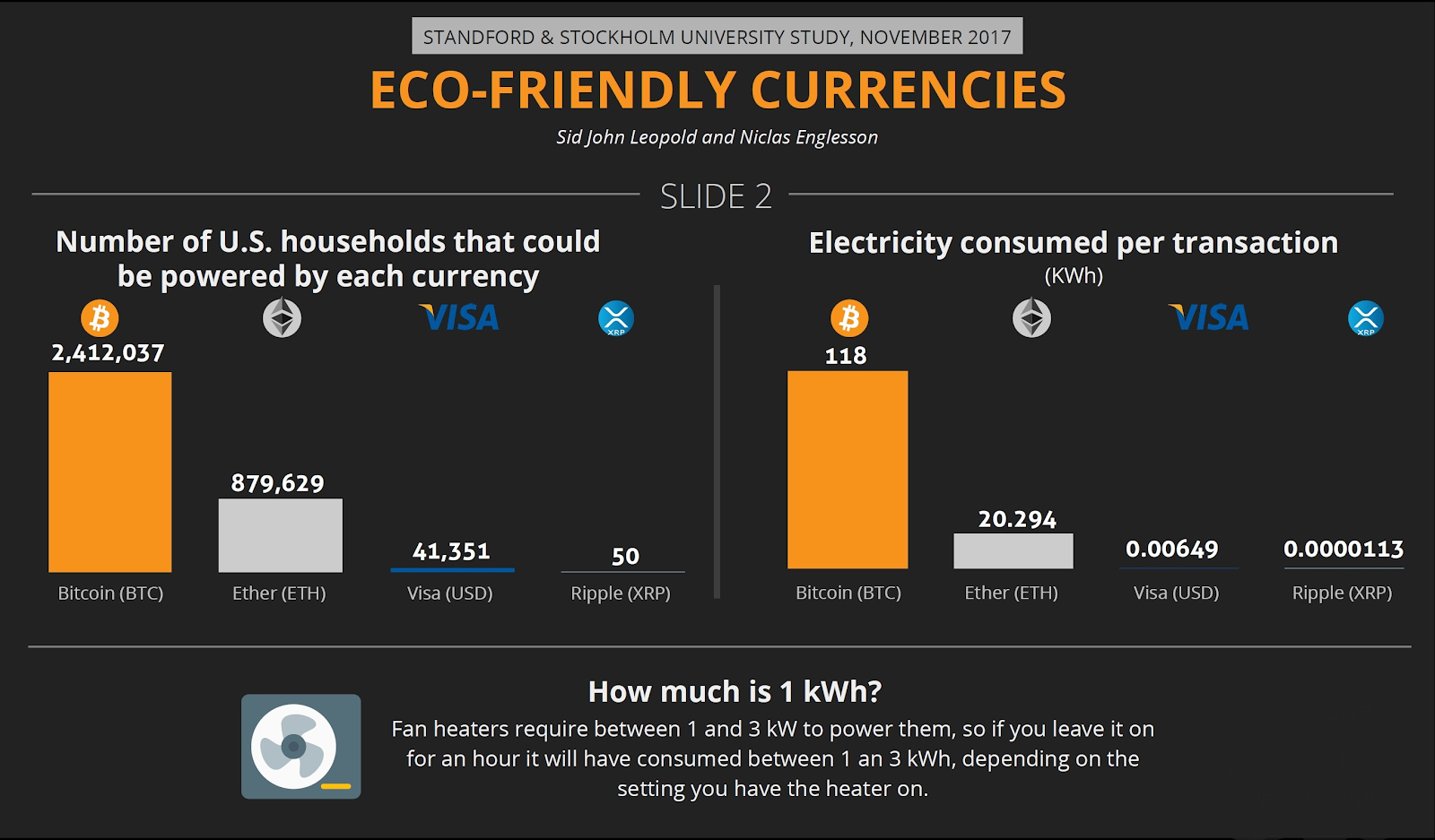

One of the biggest complaints about early blockchain systems like Bitcoin was that they were too slow, too expensive to use, and bad for the environment. But in the last few years, major breakthroughs have made these systems much more efficient.

-

Layer 2 solutions are being built on top of existing blockchains to speed things up and reduce costs. For example, the Lightning Network lets people send Bitcoin instantly and for almost no fees.

-

Interoperability tools now let different blockchains “talk” to each other, which was a big limitation before. This allows smoother transfers between networks like Ethereum, Solana, and Avalanche.

-

A major upgrade called Ethereum 2.0 switched the network from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This reduced Ethereum’s energy use by over 99%, making it far more eco-friendly.

These improvements show that blockchain isn’t stuck in the past—it’s evolving quickly and becoming more suitable for real-world use.

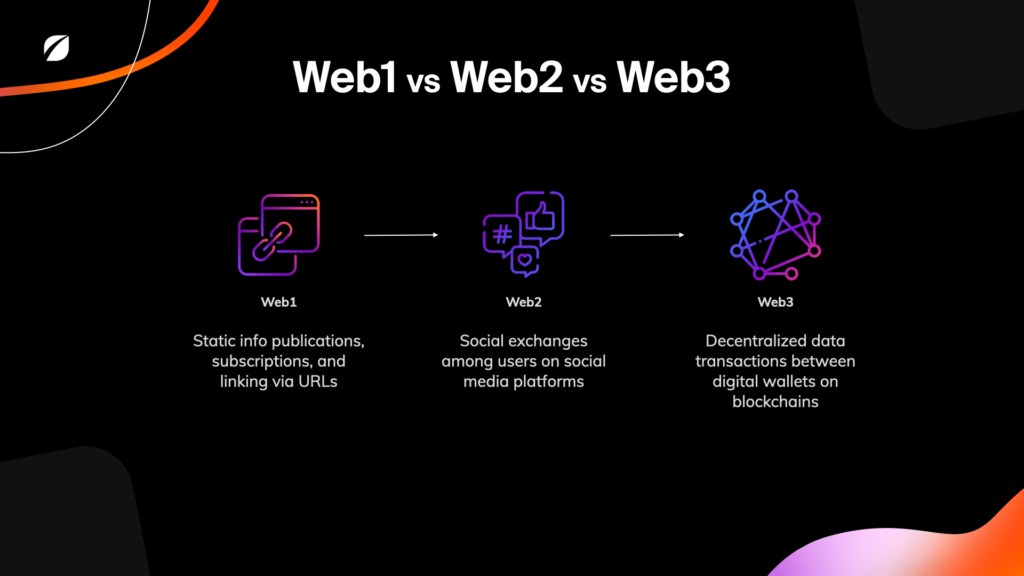

Right now, most of the internet works in a way that gives a lot of control to just a few massive companies. This is often called Web2 — the current version of the web, where platforms like Instagram, YouTube, Amazon, and Google make the rules. They control what we can post, how we earn money online, and most importantly, they own and profit from our data.

But with the rise of blockchain and DLT (distributed ledger technology), a new version of the internet is forming — called Web3. It’s a shift away from central control, and it gives users more ownership, privacy, and choice. Here’s how:

🔓 Decentralised Apps (dApps)

Web3 is built on decentralised applications or dApps. These are apps that don’t rely on a central company to run them. Instead, they run on blockchain networks, which are shared by users all over the world.

For example:

-

Uniswap lets people trade cryptocurrencies directly, without needing a bank or broker.

-

Audius is like a Web3 version of Spotify, where musicians keep more of their earnings and fans can help support them directly.

-

Lens Protocol is a social media platform where you own your profile, and no one can delete your account or sell your data without your consent.

These dApps are open-source, transparent, and can’t easily be shut down. This gives users more freedom and removes the “middlemen” who normally take a cut of everything.

🗳️ DAOs: Community Ownership Instead of CEOs

Web3 also introduces something called a DAO — a Decentralised Autonomous Organisation. A DAO is like a company or club that has no single leader. Instead, decisions are made by members who vote using special crypto tokens.

This means people can:

-

Vote on changes to a project or app (like what features should be added).

-

Control a shared fund or treasury.

-

Be rewarded for contributing to a project’s growth.

For example, Friends With Benefits DAO is a creative community that funds art, events, and collaborations — all governed by its members. MakerDAO is a financial DAO that runs a stablecoin (DAI) and lets users help manage the system.

This kind of structure lets anyone be part of building and owning something online — not just employees or investors.

As someone growing up in the digital age, I think it’s crucial for our generation to understand where all this is heading. Even if you’re not interested in coding or investing, the ideas behind crypto and blockchain—transparency, decentralisation, and ownership—are going to shape how we live and work.

But it’s not all perfect. Crypto is still volatile, and many people have lost money. There are also technical barriers and security risks. That’s why education and responsible development are key.

In my opinion, blockchain and crypto shouldn’t just be about making a quick profit. They should be used to build fairer systems, protect our privacy, and give people more control over their digital lives.

We’re the generation that’s going to live through this transformation—so it’s time we start learning about it now.